capital gain tax philippines|Capital Gains Tax in the Philippines: A complete guide : Manila What is the capital gains tax rate in the Philippines? According to Section 24D, capital gains from the sale of real estate properties in the Philippines have a capital gains tax of 6 percent, . Located right in the heart of Legaspi City Albay - it very accessible and easy to get to. The guesthouse itself is spotless - unbelievably clean and well maintained along. " Breakfast included. . Legazpi Hotels Legazpi Bed and Breakfast Flights to Legazpi Legazpi Restaurants Things to Do in Legazpi Legazpi Travel Forum Legazpi Photos .Apartado 5, 7230-000 Barrancos, Portugal – Excelente localização - mostrar mapa Depois de efetuar a reserva, todos os dados da propriedade, incluindo o número de telefone e endereço, são providenciados na sua confirmação de reserva e na sua conta. . A paisagem é impecável. Também comi na hora do almoço no café/restaurante do .

PH0 · Tax Information

PH1 · Q&A: What is Capital Gains Tax and Who Pays for It?

PH2 · Overview of Capital Gains Tax in the Philippines

PH3 · How To Compute, File, and Pay Capital Gains Tax in the

PH4 · Capital Gains Tax: How it Works and What You Need to Know

PH5 · Capital Gains Tax: How it Works and What You

PH6 · Capital Gains Tax in the Philippines: Who Pays?

PH7 · Capital Gains Tax in the Philippines: A complete guide

PH8 · Capital Gains Tax calculator for the Philippines

PH9 · Capital Gains Tax Philippines [Complete Overview & Computation Guide]

PH10 · Capital Gains Tax Philippines [Complete Overview

PH11 · Capital Gains Tax

the sports betting discord NFL NBA MLB NHL Soccer Tennis College Football picks parlay chat with the best odds community | 128792 members

capital gain tax philippines*******Capital Gains Tax is a tax imposed on the gains presumed to have been realized by the seller from the sale, exchange, or other disposition of capital assets located in the Philippines, including pacto de retro sales and other forms of conditional sale.Capital Gains Tax is a tax imposed on the gains presumed to have been realized . Capital Gains Tax (CGT) is a levy on the profit from the sale of non-inventory assets in the Philippines. The CGT rate for real property is fixed at 6% of the . Understanding how capital gains tax works in the Philippines is crucial for investors and individuals engaged in buying and selling assets. By knowing the rates, exemptions, and filing .

What is the capital gains tax rate in the Philippines? According to Section 24D, capital gains from the sale of real estate properties in the Philippines have a capital gains tax of 6 percent, .

Capital gains tax on sale of real property located in the Philippines and held as capital asses is based on the presumed gains. The rate is 6% capital gains tax based on the higher . The Capital Gains Tax on real property in the Philippines is set at a flat rate of 6%. This rate applies to the gross selling price, the Bureau of Internal Revenue (BIR) .capital gain tax philippinesIn the Philippines, the sale of real property classified as a capital asset is subject to a 6% capital gains tax based on either the property's selling price, its current fair market value, .

Capital Gains Tax is a tax imposed on the gains presumed to have been realized by the seller from the sale, exchange, or other disposition of capital assets located in the .

Capital Gains Tax in the Philippines: A complete guideCapital Gains Tax is a tax imposed on the gains presumed to have been realized by the seller from the sale, exchange, or other disposition of capital assets located in the .

Use our Capital Gains Tax calculator for the Philippines to compute the real estate CGT you have to pay on the sale of property in the Philippines.Capital Gains from Sale of Real Property. According to section 24C of the National Internal Revenue Code of the Philippines (NIRC), the capital gains tax rate of six percent (6%) is based on the gross selling price or current fair market value as determined in 24 accordance with Section 6 (E) of this Code, whichever is higher, is hereby imposed .

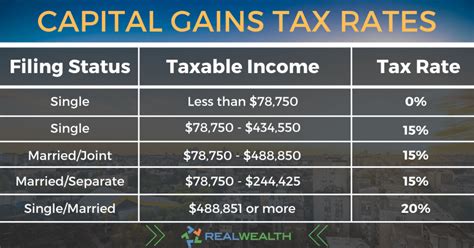

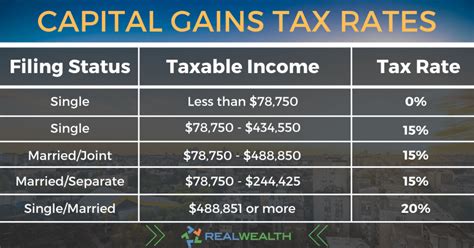

The Capital Gains Tax Return (BIR Form No. 1706) shall be filed electronically in any of the available electronic platforms [e.g., eBIR Forms, tax returns filing application/solutions of Authorized Taxpayer Service Providers (ATSPs)] and paid electronically through the available ePayment Channels or manually through any Authorized Agent Banks (AABs), . Strategic planning and understanding of tax rules can significantly reduce capital gains tax liability. Understanding Capital Gains Tax. Capital gains tax, a levy on the profit from selling non-business assets such as homes or vehicles, stands at 6% in the Philippines, calculated on the gross sale price or the asset’s fair market value. According to Section 39 of the Philippine Tax Code, capital assets are properties sold that does not fall under the following criterion: . pesos. Your profit or sales is the remaining 500,000 (the difference of 3,500,000 from 3,000,000 pesos), subject to the capital tax gain. Obviously, you do not have to pay the tax until it is sold. However .First Php 100,000, taxed at 5%. In excess of Php 100,000, taxed at ten percent 10%. However, under the TRAIN law effective 01 January 2018, if the transferor is a domestic corporation, the capital gains tax rate will be levied at a flat rate of 15% regardless of the amount of net capital gains.Tax Information. Capital Gains Tax is a tax imposed on the gains presumed to have been realized by the seller from the sale, exchange, or other disposition of capital assets located in the Philippines, including pacto de retro sales and other forms of conditional sale. Documentary Stamp Tax is a tax on documents, instruments, loan agreements .capital gain tax philippines Capital Gains Tax in the Philippines: A complete guide Using the Capital Gains Tax calculator for the Philippines. Our CGT Calculator is user-friendly and requires only one step to provide you with an accurate estimation of your capital gains tax obligations: Enter the selling price or fair market value: Input the total amount for which the property was sold or input the current fair market . “(1) Capital Assets. – the term ‘capital assets’ means property held by the taxpayer (whether or not connected with his trade or business), but does not include • stock in trade of the taxpayer or other property of a kind which would properly be included in the inventory of the taxpayer if on hand at the close of the taxable year, or • property held by .

SIGN UP FOR SPRINGBOK CASINO NOW How to Recover a Password? Being in the world of digital technology, where you are constantly signing up for something and researching things, forgetting your password is a common thing. But when it comes to Springbok casino, there’s no need to worry. The site offers a simple and secure .

capital gain tax philippines|Capital Gains Tax in the Philippines: A complete guide